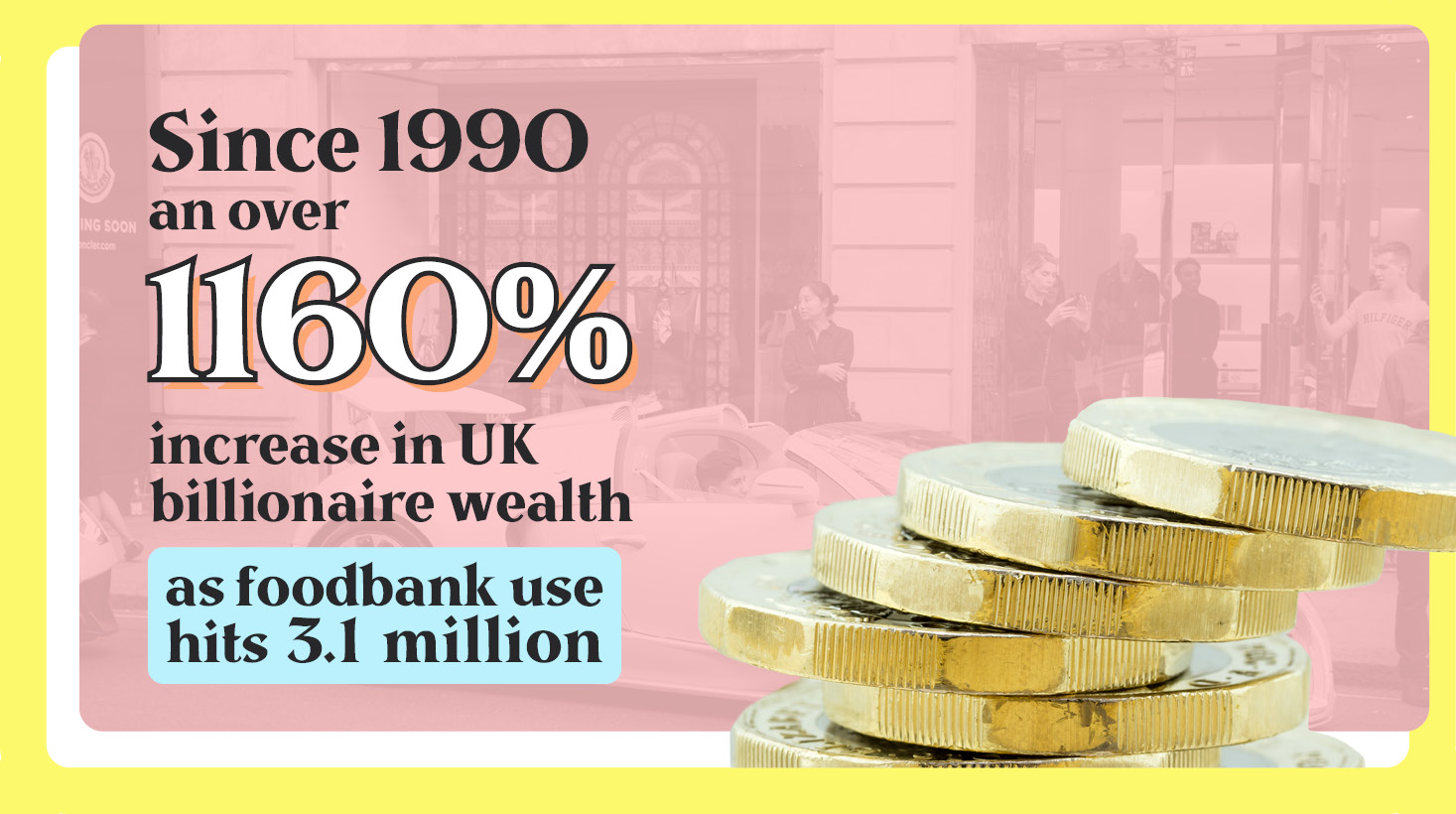

Since 1990, Billionaires in the UK have increased their wealth by over 1160%.

Billionaire wealth in 1990: £53.9bn

Billionaire wealth in 2024: £679.2bn

Billionaire wealth in 1990: £53.9bn

In 1990, there were only 15 billionaires in the UK. There are now 165. This increase is well above the rate of inflation, and the rest of us haven’t gotten this much richer in the last 34 years, so what’s happened?

Changes to the UK economy have consistently funnelled wealth upwards to the very wealthy, to the detriment of the rest of us.

While the UK’s billionaires seem to draw their wealth from many different sources, the majority draw their wealth from finance and owning property. Two underlying structural changes have enabled massive accumulation by those at the top:

Firstly, the UK economy has become increasingly based on finance and seeking returns from financial trading, rather than producing goods or services. This has allowed those with wealth to use that wealth to secure ever greater returns, simply by having a large amount of wealth. It also inflates asset prices and has shifted the balance of power in corporations to favour profits over wages.

Secondly, and relatedly, the UK has become a major destination for extreme wealth, a role facilitated by the deregulation of the financial sector, lax transparency laws and the UK’s colonial history.

The last few years have been a great example of this: profits in utility companies, UK banks, and supermarkets have risen enormously – tenfold in British Gas and over 700% for the big 4 banks. These profits are built off the rising prices we pay, but the profits have disappeared into the pockets of shareholders, and wages fallen in real terms.